FAQ

Go to category: General

General

What is a virtual gas storage?

Virtual gas storage

A virtual gas storage is similar to a gas storage contract, however it is not (fully) backed by a physical storage. Virtual products have typical simpler contract characteristics than those with fully physical backed products. This increases the ease of negotiating and trading such contracts.

Owners with multiple storages may combine the characteristics of the storages into one virtual version. The resulting pooling effect lead to less physical restriction and a commercially more attractive product.

Virtual gas storage products are traded bilateral between market participants, via brokers or via auctions.

Owners of multiple physical gas storage facilities may combine the characteristics into one virtual version to create a commercially more attractive product.

KYOS Software models and Advisory

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Since the start of KYOS in 2008, our mission is to serve professionals in the energy business (power, natural gas and renewable) or those working with commodities with superior models to aid with decision-making. Use our analytical models to your advantage!

Please contact us for more information, just fill out the form in the black section below.

What is a gas storage marketing?

Gas storage marketing

Gas storage marketing is the process of selling gas from underground gas storages to energy suppliers. Storage owners can sell (parts) of the storage to third parties as storage contracts. Depending on the regulatory regime it can even be a requirement to offer all capacity into the market. Most storage owners offer so-called standard storage bundles. A standard storage bundle contains a fixed ratio of injection capacity, withdrawal capacity and working gas volume. The ratio depends on the physical characteristics of the storage facility. Storage owners can also offer non-standard storage products, sometimes including even only injection capacity, withdrawal capacity or working gas volume.

Generally speaking, storage contracts can be marketed during pre-announced auctions, during bilateral negotiations or as a result of regulatory allocation. Storage contracts can be for one storage year, multiple storage years or for shorter periods.

Furthermore, the transfer of storage rights is governed by a standard storage agreement (SSA).

Gas storage marketing is the process of selling gas from underground gas storages to energy suppliers, though auctions, negotiations or regulatory allocations.

KYOS Software models and Advisory

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

What is cushion gas?

Cushion gas

Cushion gas is the amount of gas that is permanently stored in a natural gas storage. The main function is to maintain sufficient pressure in the storage to allow for adequate injection and withdrawal rates at all times. Another name for this type of gas is base gas.

The amount of required cushion gas depends on the type of storage. For example, in depleted gas reservoirs around 50% of the total volume consists of cushion gas. In comparison, salt caverns require typically around 25% of the total volume. Aquifer reservoirs require more: up to 80% of the total volume. In short, the exact amount required depends on the exact characteristics of the storage and the required withdrawal rates.

A natural gas storage requires cushion gas, or base gas to maintain sufficient pressure in the cavern. This way, it allows for adequate injection and withdrawal rates at all times.

As a result, cushion gas is an important cost element for a gas storage project. It can amount to 50%-80% of the total investment costs. You can only withdraw this gas at the end of the lifetime of a gas storage facility.

KYOS Software models and Advisory

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

What is working gas volume?

Working Gas Volume

The working gas volume (WGV) is the amount of natural gas that can be injected, stored and withdrawn during the normal commercial operation of a natural gas storage facility. The definition of WGV is the total volume of a gas storage minus the cushion gas. The cushion gas is the gas that is required to stay in the gas storage to maintain adequate pressure and injection and withdrawal rates in the storage.

KYOS Software models and Advisory

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

What is a gas storage?

A natural gas storage is a facility that can store natural gas for an indefinite period of time. Natural gas storages are typically located underground and are therefore called as well underground gas storages, or UGS.

The main function of gas storages is to inject and store natural gas at time of low prices and/or low demand and use the gas by withdrawing at times of higher prices and/or higher demand. We can identify three parameters to characterize a gas storage: working gas volume, injection capacity and withdrawal capacity.

The working gas volume is the amount of gas that can be injected into the storage and withdrawn at a later moment in time during normal commercial operation. The working gas volume is smaller than the total volume of the storage. A part of the storage volume needs always be filled with gas. This so-called cushion gas is required to maintain sufficient pressure in the storage to allow for adequate withdrawal rates.

The injection and withdrawal capacity define the maximum rate gas that one can respectively inject or withdraw from the storage. The injection and withdrawal capacity is typically dependent on the pressure level inside the storage. The pressure level depends on the amount of working gas injected, the inventory level.

The inventory level dependent injection and withdrawal parameters are also called ratchets. In case little working gas is injected into the storage, the pressure inside the storage is relatively low. As a result, the injection capacity is typically at its maximum value and the withdrawal capacity at its lowest value. The more working gas is injected into the storage, the higher the pressure. Consequently, the injection capacity decreases and the withdrawal capacity increases.

The storage cycling rate is the number of times a storage can be fully filled and emptied during one year. The cycling rate indicates the main usage of the storage. It is defined by the ratio between injection/withdrawal capacities and the working gas volume. Storages with an injection/WGV ratio of over 100 days are called seasonal storages. These storage have a cycling rate close to 1 and can only be used for one full storage cycle per year.

Seasonal storages are typically used to inject gas during the summer and withdrawal during the winter. Thereby creating the required profile required to supply natural gas to residential customers. Storages with injection/WGV ration of less than 30 days are called fast-churn storages. Fast-churn storages have multiple full storage cycles during a year. These storages are typically used for short-term balancing of a portfolio and/or arbitrage short-term price differentials

The most common types of gas storages are depleted gas reservoirs, salt caverns and aquifer reservoirs.

Depleted gas reservoirs are existing geological formations that have produced parts or all of the economically recoverable gas. The porous rock of many of these formations can be used again to inject, storage and withdrawal natural gas. Using depleted gas reservoirs can have advantages over other types of gas storage. Unproduced gas in the formations can be used as cushion gas, thereby lowering the investment costs. Furthermore, gas reservoirs are in many cases linked to existing gas infrastructure, again lowering investment costs. The cushion gas requirement of depleted gas reservoirs is in the order of 50% of the total storage volume. Gas storages located in depleted reservoirs have typically large working gas volumes, in the order of magnitude of hundreds of million cubic meters up to several billion cubic meters. Most storages in depleted fields are seasonal storages.

Salt caverns are man-made structures in thick layers of underground salt formations. The cavern are created by pumping fresh water down a borehole into the salt layer. The salt dissolves in the water and is pumped back to the surface. This process continues until the required size of the cavern is reached. Salt cavern storages require much less cushion gas than storages in depleted gas reservoirs, typically 25% of the total storage volume. Salt caverns are typically fast-churn storages.

Aquifers are natural, underground, porous formations that contain water reservoirs. The formation can be used to store natural gas. The process of converting a aquifer into a gas reservoir is typically long and expensive. The initial injection cycles need to be very slow to carefully push away the water. The amount of cushion gas required for an aquifer is high and can be up to 80% of the total gas volume. Aquifer gas storages are typically very large and used as seasonal storage.

A natural gas storage site consists of the following main elements:

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

The main function of gas storages is to inject and store natural gas at time of low prices and/or low demand and use the gas by withdrawing at times of higher prices and/or higher demand. We can identify three parameters to characterize a gas storage: working gas volume, injection capacity and withdrawal capacity.

Working gas volume

The working gas volume is the amount of gas that can be injected into the storage and withdrawn at a later moment in time during normal commercial operation. The working gas volume is smaller than the total volume of the storage. A part of the storage volume needs always be filled with gas. This so-called cushion gas is required to maintain sufficient pressure in the storage to allow for adequate withdrawal rates.

Injection and withdrawal capacity

The injection and withdrawal capacity define the maximum rate gas that one can respectively inject or withdraw from the storage. The injection and withdrawal capacity is typically dependent on the pressure level inside the storage. The pressure level depends on the amount of working gas injected, the inventory level.

The inventory level dependent injection and withdrawal parameters are also called ratchets. In case little working gas is injected into the storage, the pressure inside the storage is relatively low. As a result, the injection capacity is typically at its maximum value and the withdrawal capacity at its lowest value. The more working gas is injected into the storage, the higher the pressure. Consequently, the injection capacity decreases and the withdrawal capacity increases.

Storage cycling rate

The storage cycling rate is the number of times a storage can be fully filled and emptied during one year. The cycling rate indicates the main usage of the storage. It is defined by the ratio between injection/withdrawal capacities and the working gas volume. Storages with an injection/WGV ratio of over 100 days are called seasonal storages. These storage have a cycling rate close to 1 and can only be used for one full storage cycle per year.

Seasonal storages are typically used to inject gas during the summer and withdrawal during the winter. Thereby creating the required profile required to supply natural gas to residential customers. Storages with injection/WGV ration of less than 30 days are called fast-churn storages. Fast-churn storages have multiple full storage cycles during a year. These storages are typically used for short-term balancing of a portfolio and/or arbitrage short-term price differentials

Types of gas storages

The most common types of gas storages are depleted gas reservoirs, salt caverns and aquifer reservoirs.

Depleted gas reservoirs are existing geological formations that have produced parts or all of the economically recoverable gas. The porous rock of many of these formations can be used again to inject, storage and withdrawal natural gas. Using depleted gas reservoirs can have advantages over other types of gas storage. Unproduced gas in the formations can be used as cushion gas, thereby lowering the investment costs. Furthermore, gas reservoirs are in many cases linked to existing gas infrastructure, again lowering investment costs. The cushion gas requirement of depleted gas reservoirs is in the order of 50% of the total storage volume. Gas storages located in depleted reservoirs have typically large working gas volumes, in the order of magnitude of hundreds of million cubic meters up to several billion cubic meters. Most storages in depleted fields are seasonal storages.

Salt caverns are man-made structures in thick layers of underground salt formations. The cavern are created by pumping fresh water down a borehole into the salt layer. The salt dissolves in the water and is pumped back to the surface. This process continues until the required size of the cavern is reached. Salt cavern storages require much less cushion gas than storages in depleted gas reservoirs, typically 25% of the total storage volume. Salt caverns are typically fast-churn storages.

Aquifers are natural, underground, porous formations that contain water reservoirs. The formation can be used to store natural gas. The process of converting a aquifer into a gas reservoir is typically long and expensive. The initial injection cycles need to be very slow to carefully push away the water. The amount of cushion gas required for an aquifer is high and can be up to 80% of the total gas volume. Aquifer gas storages are typically very large and used as seasonal storage.

Components of gas storage site

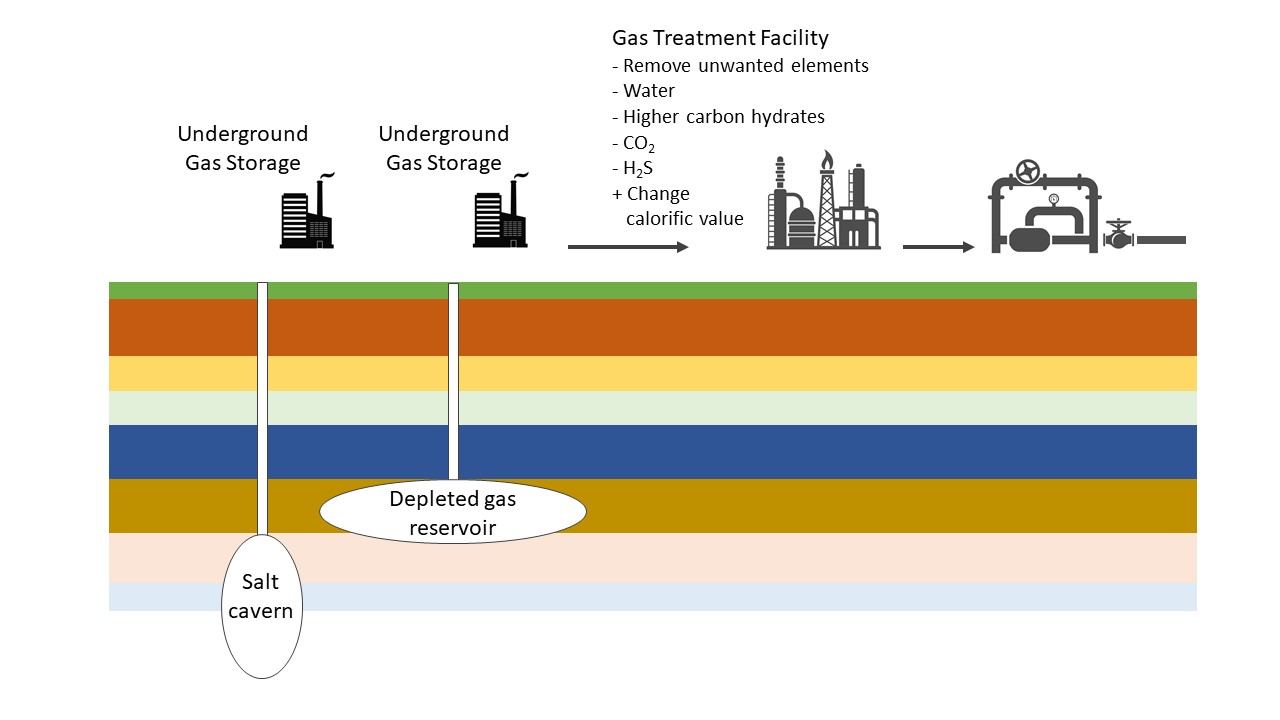

A natural gas storage site consists of the following main elements:

- Storage wells to inject and withdrawal the gas from the underground storage.

- Compressors to inject the gas into and withdrawal from the storage. During the injection compression is necessary in case the storage pressure is higher than the pipeline pressure, typically at high storage level. During withdrawal compression is necessary in case the storage level is lower than the pipeline pressure, typically at low storage level.

- Gas treatment facility. Gas that is withdrawn from the storage may not be at the required specification from the pipeline network. This step may include the removal of unwanted elements, water, higher carbon hydrates, CO2 and H2S. It may also be required to change the calorific value or Wobbe index of the gas before releasing the gas into the gas network.

KYOS Software models and Advisory

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

What is a swing option?

A swing option is a contract which provides flexibility as to when and how much of a commodity is taken. The offtaker of the commodity can "swing" (change) the quantity each hour or day. It is most commonly used in natural gas markets, but also in electricity, oil and other commodity markets.

Another name for a swing option is take-or-pay, or take-and-pay contract. This name refers to the minimum quantity that should be taken, or if not taken, should still be paid for. Such a minimum is one of the many volumetric constraints that are possible. Typical constraints are minimum and maximum daily contract quantities (DCQ), annual contract quantities (ACQ) and total contract quantities (TCQ). But essentially, there can be any type of constraint. When a constraint is violated, the option holder pays a penalty.

The price paid for the commodity can be fixed or floating. A floating price or indexed price means that it is the linked to the price or prices in the market. Compared to a fixed price contract, an indexed price contract contains less optionality: the difference between the contract price and the market price is generally smaller and less volatile. This reduces the arbitrage trading opportunities in the market, and hence the option value. On the other hand, if the contract is primarily entered into for acquiring the commodity, not for trading purposes, then an indexed contract ensures that a price close to the market is paid.

Swing contracts offer multiple interdependent exercise moments: they belong to the class of American-style path-dependent options. This means that most of the swing contracts cannot be broken down into plain-vanilla options and hence not be priced with standard solutions, such as the Black-Scholes formula. The market standard methodologies for valuing swing contracts are least-squares Monte Carlo and rolling intrinsic. Both methodologies are embedded in KySwing, a software product dedicated to swing contracts. It calculates the market value, value distributions, delta hedges and a range of other option Greeks.

Do you want to know more about swing options, read our monthly gas market report or check the KySwing web page.

Another name for a swing option is take-or-pay, or take-and-pay contract. This name refers to the minimum quantity that should be taken, or if not taken, should still be paid for. Such a minimum is one of the many volumetric constraints that are possible. Typical constraints are minimum and maximum daily contract quantities (DCQ), annual contract quantities (ACQ) and total contract quantities (TCQ). But essentially, there can be any type of constraint. When a constraint is violated, the option holder pays a penalty.

The price paid for the commodity can be fixed or floating. A floating price or indexed price means that it is the linked to the price or prices in the market. Compared to a fixed price contract, an indexed price contract contains less optionality: the difference between the contract price and the market price is generally smaller and less volatile. This reduces the arbitrage trading opportunities in the market, and hence the option value. On the other hand, if the contract is primarily entered into for acquiring the commodity, not for trading purposes, then an indexed contract ensures that a price close to the market is paid.

Swing contracts offer multiple interdependent exercise moments: they belong to the class of American-style path-dependent options. This means that most of the swing contracts cannot be broken down into plain-vanilla options and hence not be priced with standard solutions, such as the Black-Scholes formula. The market standard methodologies for valuing swing contracts are least-squares Monte Carlo and rolling intrinsic. Both methodologies are embedded in KySwing, a software product dedicated to swing contracts. It calculates the market value, value distributions, delta hedges and a range of other option Greeks.

Do you want to know more about swing options, read our monthly gas market report or check the KySwing web page.

What is an indexed contract?

An indexed contract is very common in commodity markets, especially gas markets. It is also referred to as floating or variable price contract. It means that the price paid for the commodity depends on the evolution of market prices, spot or forward. The index price may be the price on that day or the average price over a certain historical time window.

The index may consist of settlement prices from an exchange or price assessments from an agency such as Platt’s, Argus or ICIS Heren. It is important to select the right index price. Firstly, the market price(s) must be published by a trustworthy organization, now and in the future, using a transparent methodology. Secondly, the market of the index must be sufficiently liquid to ensure that no party can easily manipulate the level of the index price. Finally, if the index market (e.g. Henry Hub) is different from the physical market (a local hub), it should be strongly correlated with the physical market or else have a strong correlation with the exposure of the buyer.

Depending on the portfolio and activities of the buyer and seller, an indexed contract is good for managing risks. For example, if the buyer wants absolute price certainty over the duration of the contract, then it is safer to buy at a fixed price. However, if he always wants to be close to the market, then an indexed contract is the better choice.

An indexed contract tends to contain less optionality than a fixed price contract: the difference between the contract price and the market price is generally smaller and less volatile. This reduces the arbitrage trading opportunities in the market, and hence the option value.

Advanced financial methodologies are needed for the calculation of the market option value, the price exposures, and the daily management of indexed contracts. KYOS is a specialist in this area with its software products KYOS Analytical Platform and KySwing.

Do you want to know more about swing options, read our monthly gas market report or check the KySwing webpage.

The index may consist of settlement prices from an exchange or price assessments from an agency such as Platt’s, Argus or ICIS Heren. It is important to select the right index price. Firstly, the market price(s) must be published by a trustworthy organization, now and in the future, using a transparent methodology. Secondly, the market of the index must be sufficiently liquid to ensure that no party can easily manipulate the level of the index price. Finally, if the index market (e.g. Henry Hub) is different from the physical market (a local hub), it should be strongly correlated with the physical market or else have a strong correlation with the exposure of the buyer.

Depending on the portfolio and activities of the buyer and seller, an indexed contract is good for managing risks. For example, if the buyer wants absolute price certainty over the duration of the contract, then it is safer to buy at a fixed price. However, if he always wants to be close to the market, then an indexed contract is the better choice.

An indexed contract tends to contain less optionality than a fixed price contract: the difference between the contract price and the market price is generally smaller and less volatile. This reduces the arbitrage trading opportunities in the market, and hence the option value.

Advanced financial methodologies are needed for the calculation of the market option value, the price exposures, and the daily management of indexed contracts. KYOS is a specialist in this area with its software products KYOS Analytical Platform and KySwing.

Do you want to know more about swing options, read our monthly gas market report or check the KySwing webpage.

What is a guarantee of origin?

A guarantee of origin (GoO) is an electronic document which proves electricity originates from a specific energy source. It is mainly issued for renewable energy sources. A guarantee of origin enables the traceability of green energy from the producer to the final consumer, even though the electricity networks obviously do not distinguish between different types of electricity.

A Guarantee of Origin (GoO) is similar to a green certificate, in that it proofs that power has been produced from a specific source. However, GoOs can be issued independently from governmental policies. Furthermore, GoOs do not necessarily apply to renewable production only, although the renewable GoOs are most common, such as for Nordic and Alpine hydro power, and Northern continental Europe wind power.

The price of the guarantee of origin depends on the willingness of final consumers to pay for green energy. Furthermore, the price depends on the specific source: a Nordic hydro power GoO may be less valuable than a GoO of local wind or solar production. This is because consumers realize that the purchase of a hydro GoO may not lead to any incentive for more renewable production, whereas a local wind or solar GoO is more likely having an impact. It is somewhat arguable whether a guarantee of origin stimulates green investments: price levels are rather low and have very little impact on the profitability of new investments.

As opposed to emission certificates, and similar to green and white certificates, the total market size for GoOs is quite small and trading rather illiquid, maybe with the exception of two or three types of GoO. Most trading activity is via brokers, such as STX, Cleanworld, Evolution Markets and Amsterdam Capital Trading.

Do you want to know more about the KYOS price forecasting services, read more on Price Analytics or contact us directly.

A Guarantee of Origin (GoO) is similar to a green certificate, in that it proofs that power has been produced from a specific source. However, GoOs can be issued independently from governmental policies. Furthermore, GoOs do not necessarily apply to renewable production only, although the renewable GoOs are most common, such as for Nordic and Alpine hydro power, and Northern continental Europe wind power.

The price of the guarantee of origin depends on the willingness of final consumers to pay for green energy. Furthermore, the price depends on the specific source: a Nordic hydro power GoO may be less valuable than a GoO of local wind or solar production. This is because consumers realize that the purchase of a hydro GoO may not lead to any incentive for more renewable production, whereas a local wind or solar GoO is more likely having an impact. It is somewhat arguable whether a guarantee of origin stimulates green investments: price levels are rather low and have very little impact on the profitability of new investments.

As opposed to emission certificates, and similar to green and white certificates, the total market size for GoOs is quite small and trading rather illiquid, maybe with the exception of two or three types of GoO. Most trading activity is via brokers, such as STX, Cleanworld, Evolution Markets and Amsterdam Capital Trading.

Do you want to know more about the KYOS price forecasting services, read more on Price Analytics or contact us directly.

What is a white certificate?

A white certificate is a tradable asset which proofs that a certain percentage of energy savings has been achieved relative to a baseline. It is also referred to as Energy Savings Certificate (ESC) or Energy Efficiency Credit (EEC). A white certificate trading scheme may be compared to a green certificate and an emission certificate trading scheme, which all aim to promote a cleaner environment. Green certificates are issued for achieving a minimum of renewable energy production, white certificates for achieving a minimum of energy savings, and emission credits for achieving a maximum of carbon emissions.

The white certificate schemes encourage companies and their clients to save energy through various investments in energy efficiency which are rewarded by certificates credited by registered agencies. The savings are calculated as the cumulative savings over the lifetime of the product or the investment. White certificates are traded in Poland, France and Italy. In France, the name for the white certificates is Certificat d'Economies d'Energie (CEE) and the tradable unit is ‘MWh cumac’. In Poland and Italy, the white certificates are called EFX and TEE respectively, and traded in tonne of oil equivalent (toe). Other countries are considering to introduce the mechanism of white certificates too, because it is generally considered to be an efficient and cost effective way to achieve energy savings, attractive to policy makers, companies and households.

A white certificate cannot be transferred between the European markets, as opposed to emission certificates, so the total market size is often small and trading rather illiquid. Most trading activity is via brokers, such as STX, Cleanworld, Evolution Markets and Amsterdam Capital Trading.

Do you want to know more about the KYOS price analysis services, read more on Price Analytics or contact us directly.

An explanation about green certificates can be found here.

The white certificate schemes encourage companies and their clients to save energy through various investments in energy efficiency which are rewarded by certificates credited by registered agencies. The savings are calculated as the cumulative savings over the lifetime of the product or the investment. White certificates are traded in Poland, France and Italy. In France, the name for the white certificates is Certificat d'Economies d'Energie (CEE) and the tradable unit is ‘MWh cumac’. In Poland and Italy, the white certificates are called EFX and TEE respectively, and traded in tonne of oil equivalent (toe). Other countries are considering to introduce the mechanism of white certificates too, because it is generally considered to be an efficient and cost effective way to achieve energy savings, attractive to policy makers, companies and households.

A white certificate cannot be transferred between the European markets, as opposed to emission certificates, so the total market size is often small and trading rather illiquid. Most trading activity is via brokers, such as STX, Cleanworld, Evolution Markets and Amsterdam Capital Trading.

Do you want to know more about the KYOS price analysis services, read more on Price Analytics or contact us directly.

An explanation about green certificates can be found here.

a white certificate from energy savings

What is a green certificate?

A green certificate is a tradable asset which proves that electricity has been generated by a renewable (green) energy source. It is also referred to as Renewable Energy Certificate (REC) or Renewable Obligation Certificate (ROC). A green certificate is typically issued per 1 MWh of renewable power. Alternatively, the number of green certificates may depend on the source, whereby greener or more innovative technologies may obtain more certificates than other technologies per MWh of power produced.

Green certificates are issued and traded primarily because of governmental policies which require suppliers to have a certain percentage of renewable production in their supply portfolio. With green certificates, governments can set exact targets as to the level of renewable production in a country, while the market finds the most efficient way to meet these targets. It is an alternative to other policy mechanisms, such as renewable investment subsidies, renewable production subsidies, fiscal benefits and feed-in tariffs.

A green certificate may also be considered the opposite of an emission certificate. Whereas emission certificates, such as EUA’s, impose a cost on non-renewable production and set a maximum to the total emissions, green certificates create an extra revenue for renewable production and guarantee a minimum of renewable production.

The price of the green certificates depends on the scarcity in the market. The price is higher when the green certificates scheme is driven by tight targets of government policies. European countries where green certificate policies are in place include Poland, Belgium, Sweden and the UK. The green certificate market in Italy has been replaced by feed-in-tariffs on 1 July 2016. In the UK the green certificate mechanism (ROC) will end in 2017.

A green certificate is traded separately from the power itself. Certificates cannot be transferred between the European markets, as opposed to emission certificates, so the total market size is often small and trading rather illiquid. Most trading activity is via brokers, such as STX, Cleanworld, Evolution Markets and Amsterdam Capital Trading.

Do you want to know more about the KYOS price forecasting services, read more on Price Analytics or contact us directly.

Green certificates are issued and traded primarily because of governmental policies which require suppliers to have a certain percentage of renewable production in their supply portfolio. With green certificates, governments can set exact targets as to the level of renewable production in a country, while the market finds the most efficient way to meet these targets. It is an alternative to other policy mechanisms, such as renewable investment subsidies, renewable production subsidies, fiscal benefits and feed-in tariffs.

Green certificates from hydro power

A green certificate may also be considered the opposite of an emission certificate. Whereas emission certificates, such as EUA’s, impose a cost on non-renewable production and set a maximum to the total emissions, green certificates create an extra revenue for renewable production and guarantee a minimum of renewable production.

The price of the green certificates depends on the scarcity in the market. The price is higher when the green certificates scheme is driven by tight targets of government policies. European countries where green certificate policies are in place include Poland, Belgium, Sweden and the UK. The green certificate market in Italy has been replaced by feed-in-tariffs on 1 July 2016. In the UK the green certificate mechanism (ROC) will end in 2017.

A green certificate is traded separately from the power itself. Certificates cannot be transferred between the European markets, as opposed to emission certificates, so the total market size is often small and trading rather illiquid. Most trading activity is via brokers, such as STX, Cleanworld, Evolution Markets and Amsterdam Capital Trading.

Do you want to know more about the KYOS price forecasting services, read more on Price Analytics or contact us directly.

What is a swing contract?

Swing contracts or swing options are typical components of gas contracts, which offer the opportunity to vary the contracted volume under a number of restrictions. They are also known as Take-or-Pay (ToP), interruptible and variable load contracts.

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

KYOS Software models and Advisory

Natural gas portfolio management is about managing price and volume risks. KYOS helps to optimize a portfolio with natural gas storage and swing contracts. Trade in the markets to maximize the flexibility value and minimize risks!

For example, our flagship software model KyStore supports traders and portfolio managers in natural gas markets. The gas storage optimization software not only raises revenues from gas storage trading operations, but also provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in gas storage facilities.

Please contact us for more information, just fill out the form in the black section below.

What is ETRM?

ETRM stands for Energy Trade and Risk Management. CTRM stands for Commodity Trading and Risk Management. The names are used for a range of software solutions which support the trading and risk management of commodities.

Commodity prices are often rather volatile and constitute a large portion of the total costs of production. Comprehensive ETRM and CTRM solutions support both physical and financial trading, and can deal with a wide variety of commodities, not only energy: power, natural gas, soft commodities (agri), metals, crude oil and oil derivatives, plastics, and more.

Commodity prices are often rather volatile and constitute a large portion of the total costs of production. Comprehensive ETRM and CTRM solutions support both physical and financial trading, and can deal with a wide variety of commodities, not only energy: power, natural gas, soft commodities (agri), metals, crude oil and oil derivatives, plastics, and more.

The solutions provide a transparent view of complex portfolios, and are used by energy producers, energy suppliers, large energy consumers and other companies with significant commodity price exposures. The systems aid both front office (traders), middle office and risk management, and back office.

ETRM solutions ideally provide front-to-back support. This includes:

Each system has its own strengths and weaknesses, and each focusing on particular commodities, functional areas or user groups.

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS application has been primarily designed for industrial companies with diverse commodity exposures and contracts across different business units and site locations.

Many industrial companies struggle to get a complete overview of the commodity price exposures, and this is where the KYOS application proofs to be very useful. It helps financial officers, purchasers and treasury managers to avoid unexpected losses due to commodity price movements, by providing a detailed insight in exposures, expected cash-flows, Mark-to-Market and more. It is a web based application which can easily interface with other systems and data providers. Click here to read more.

ETRM for physical and financial trading

Commodity prices are often rather volatile and constitute a large portion of the total costs of production. Comprehensive ETRM and CTRM solutions support both physical and financial trading, and can deal with a wide variety of commodities, not only energy: power, natural gas, soft commodities (agri), metals, crude oil and oil derivatives, plastics, and more.

Commodity prices are often rather volatile and constitute a large portion of the total costs of production. Comprehensive ETRM and CTRM solutions support both physical and financial trading, and can deal with a wide variety of commodities, not only energy: power, natural gas, soft commodities (agri), metals, crude oil and oil derivatives, plastics, and more.The solutions provide a transparent view of complex portfolios, and are used by energy producers, energy suppliers, large energy consumers and other companies with significant commodity price exposures. The systems aid both front office (traders), middle office and risk management, and back office.

From front-office to back-office

ETRM solutions ideally provide front-to-back support. This includes:

- deal capturing and price management

- logistics and scheduling

- position management

- risk reporting (VaR, EaR)

- valuation and optimization

- accounting, settlement, regulatory reporting

Each system has its own strengths and weaknesses, and each focusing on particular commodities, functional areas or user groups.

KYOS CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS application has been primarily designed for industrial companies with diverse commodity exposures and contracts across different business units and site locations.

Many industrial companies struggle to get a complete overview of the commodity price exposures, and this is where the KYOS application proofs to be very useful. It helps financial officers, purchasers and treasury managers to avoid unexpected losses due to commodity price movements, by providing a detailed insight in exposures, expected cash-flows, Mark-to-Market and more. It is a web based application which can easily interface with other systems and data providers. Click here to read more.