Energy Storage

- Puts a price to all types of energy storage

- Make quick calculations, fully automated

- Enjoy easy interfaces with market and other data

- Fully embedded in KYOS Analytical Platform

KyBattery supports all types of energy storage assets, including pumped hydropower storage, battery storage, hydrogen storage, compressed air energy storage (CAES) and heat storage. All of them play an increasingly important role to support balancing the electricity system.

Our KyBattery tool supports traders and portfolio managers in electricity markets. Above all, the battery storage optimization software raises revenues from battery storage trading operations, and provides accurate valuations and reduces risk with adequate hedge recommendations. The model uses advanced stochastics including Least Squares Monte Carlo techniques to capture the full optionality in battery storage facilities.

Benefits

Energy storage: What is a fair price?

First of all, our energy valuation model calculates the fair value of an energy storage. The model shows which part of the value is intrinsic and which part is extrinsic. To capture the extrinsic value, you will need to exercise a more active trading strategy.

Use the intuitive and realistic Monte Carlo simulation model with confidence to obtain your extrinsic values. The model applies a combination of forward and spot trading strategies to the simulated price scenarios, using dynamic programming and least-squares Monte Carlo. Therefore, this type of valuation provides a fair assessment of the future value.

.

Hedging: Where are your exposures?

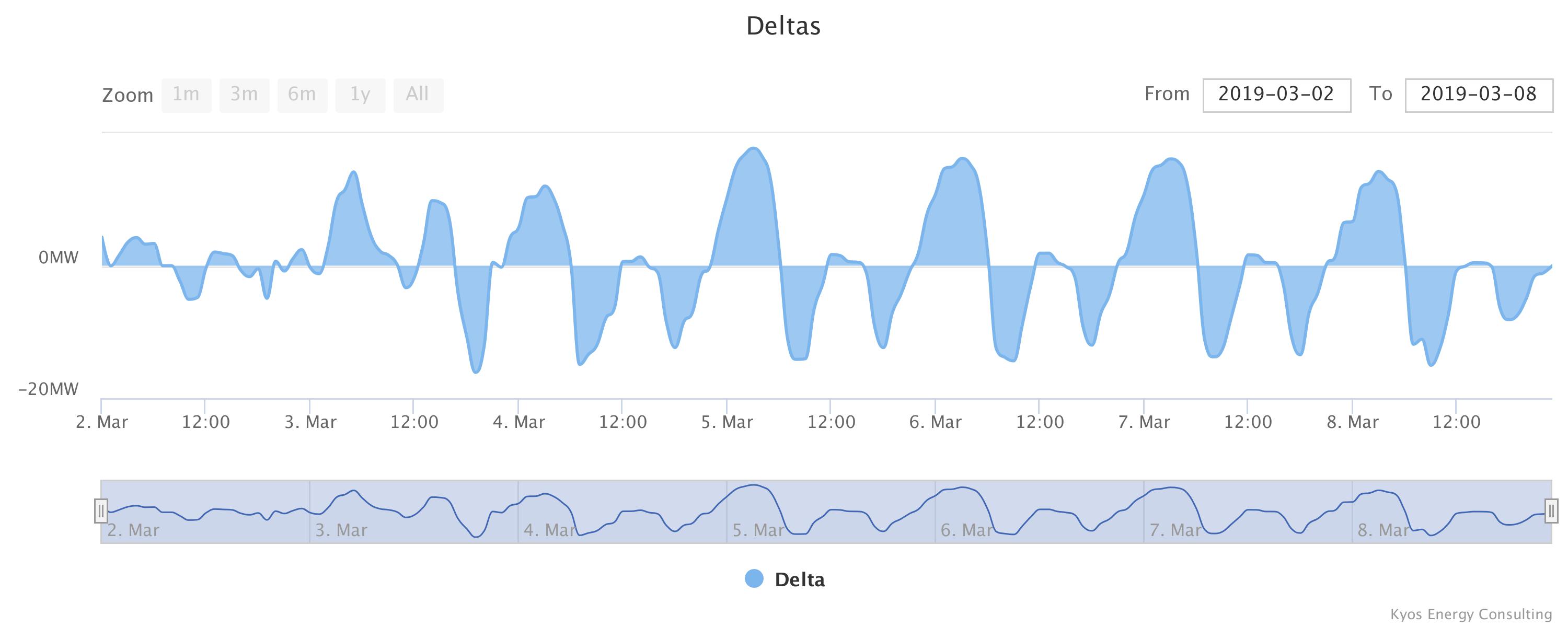

Secondly, KyBattery shows on an hourly granularity which market trades are optimal to hedge risks and lock in profits. You can choose between intrinsic hedging and delta hedging, two strategies to secure profits.

Features KyBattery

The KyBattery energy optimization software includes all storage characteristics. This includes not only time and volume dependent charge and discharge rates and efficiencies, but also time varying costs, interruption rights and reduced availability because of maintenance.

Of course we have fully integrated KyBattery in our KYOS Analytical Platform. Automated data feeds ensure that you get up-to-date trading recommendations every day. Certainly it guarantees transparency, because analysts can evaluate each individual price scenario.

Methodology

Advanced Monte Carlo simulation techniques provide the basis for the KyBattery Optimization software, using our KySim model. Important characteristics are a mean-reverting multi-factor model coupled with long-term, short-term and seasonal dynamics.

Furthermore, the volatility term structure and other simulation inputs are easily derived from historical data with the accompanying calibration tool. Alternatively, you can also use implied option volatilities, by overwriting the historical volatility estimates.

Optimization modules

Trusted by organizations all over the world

Other Solutions

Consulting Services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and Valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & Risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›Price Simulations and Analytics

Market prices, market price forecasts and simulations are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›