Power producers

KYOS assists power producers with the financial optimization of their assets:

- Gas and coal fired generation

- Renewable generation: wind, solar, hydro, biomass

- Combined heat and power generation (CHP)

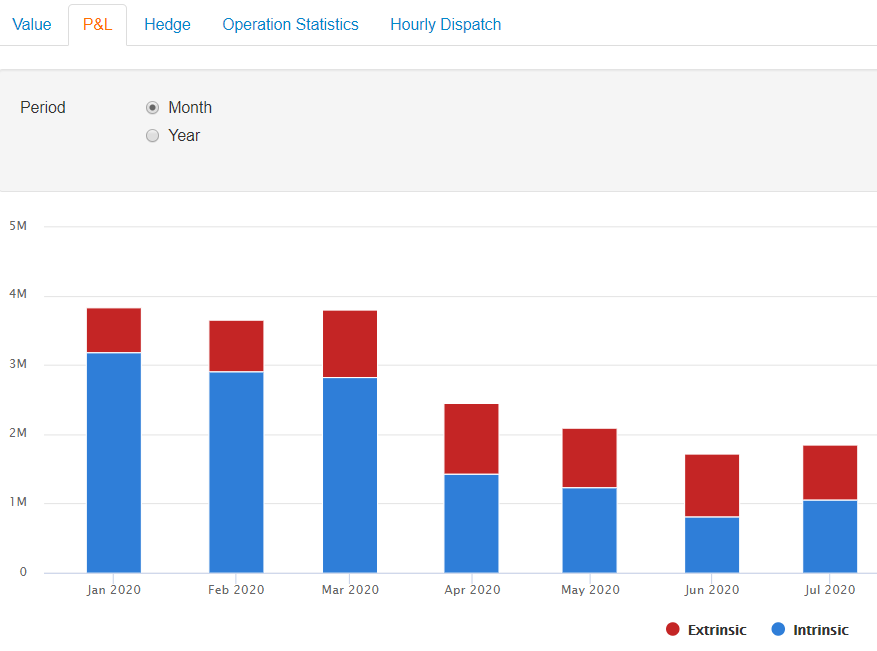

Power stations are dispatched on day ahead, intraday and balancing markets. In addition, you will need forward markets to hedge your expected future income. Another matter to consider is the time-frame: large investments in new-build or lifetime extensions can only be justified over a period of many years. KYOS specialists developed software for all these areas, from short-term to long-term. It is all incorporated in KyPlant, which is KYOS flagship product for power producers.

Advantages KyPlant

- Dispatch optimization to capture the flexibility in short-term markets

- Assess the future value of power stations, based on stochastic optimization

- Calculate distributions of future prices, production and earnings

- Calculate delta hedges and provide trade recommendations

- Create hourly price forward curves and fundamental power price forecasts

Dispatch optimization software is the basis for generating income with a power station. KyPlant takes into account all technical plant characteristics as well as the market and regulatory conditions. With the optimization results always at their fingertips, dispatchers and short-term traders can make even more money.

Loading a qoute..

Loading a qoute..

To ensure the future income of a power station, you will need an effective hedging strategy, also to reduce the earnings risk. With KyPlant it is possible to manage the risks on the basis of Monte Carlo price simulations, and adjust trades over time. KYOS power plant software generates such scenarios, calculates the earnings risk, and advises how hedges should be adjusted periodically.

Power producers need accurate price forecasts. Daily trading operations require forecasts which are derived from actual market prices (arbitrage-free), whereas strategic decisions also require forecasts derived from the market fundamentals. KYOS provides both types of price forward curves. Furthermore, we combine price forecasts with Monte Carlo simulations, for example to assess the impact of fuel price variations on power prices. As a result, the price forecasts, the price simulations, and the financial optimization software provide the tools for making better investment decisions.

Solutions

Power companies

Publications

Trusted by organizations all over the world

Other Industries

Renewable power

Sources of renewable power or green energy are the future. KYOS helps you with valuing your solar, wind, battery or pumped-hydro energy assets, as well as your (renewable) power purchase agreements (PPAs).

Read more ›Natural Gas

Natural gas portfolio management is all about managing price and volume risks. KYOS helps to optimize natural gas storage and swing contracts, and trade in the markets to maximize the flexibility value.

Read more ›LNG

KYOS offers support to LNG contract valuation, e.g for. liquefaction or regas projects, LNG off-take agreements and LNG storage contracts.

Read more ›Multi-commodity exposures

Large industrial companies are exposed to a variety of commodities. To successfully operate in a competitive market, commodity earnings risk should be well understood and managed effectively.

Read more ›