Energy Options

- Puts a price to all option types

- Make quick calculations, fully automated

- Enjoy easy interfaces with market and other data

- Fully embedded in KYOS Analytical Platform

Benefits

1. Energy Options Pricing

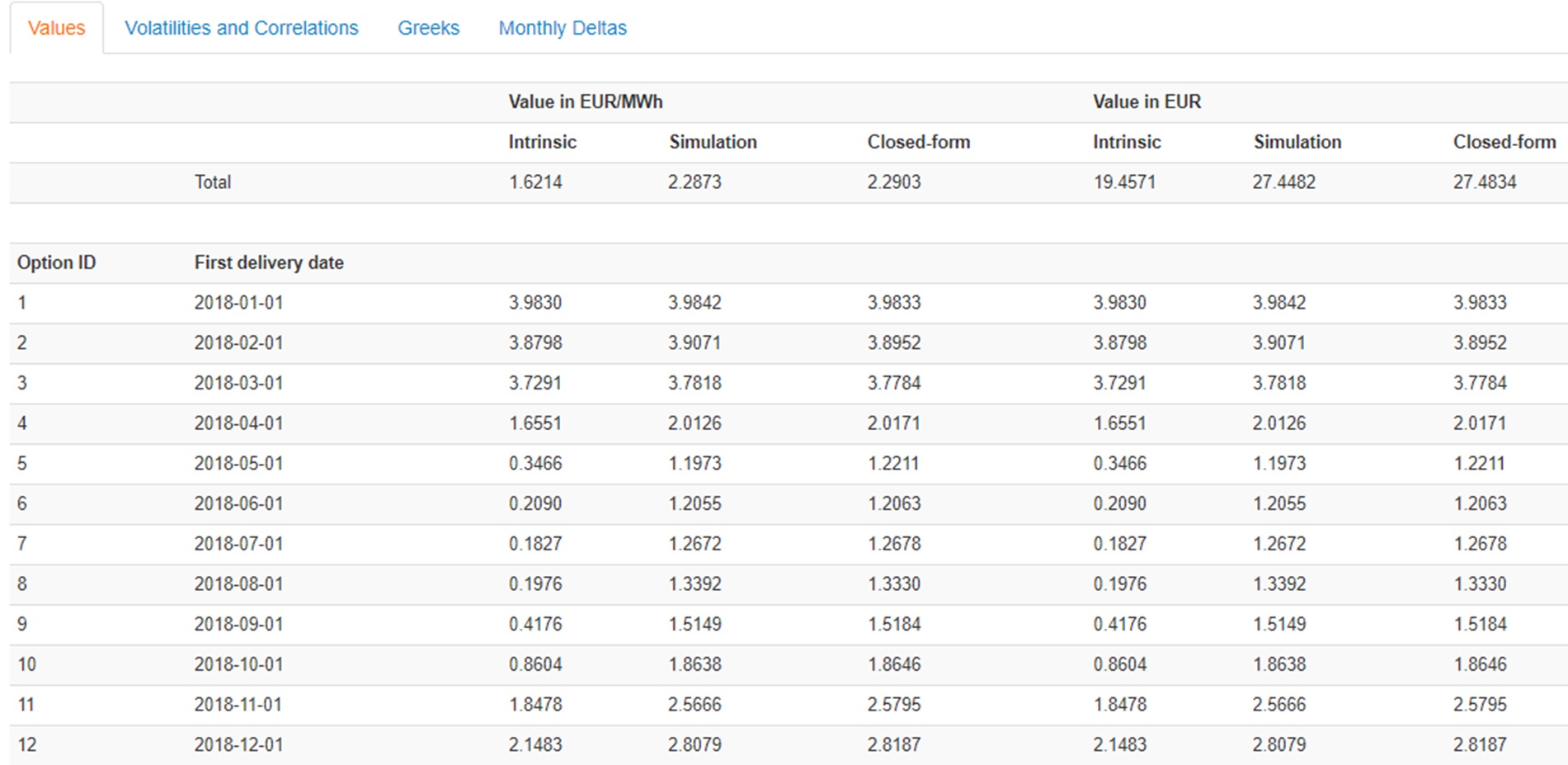

An accurate and quick pricing engine calculates the fair value of the option, using both Monte Carlo simulations and closed-form formula solutions. KyOption displays the intrinsic value as well as the total value of the option. In addition, the module can value advanced options types as commodity spread options and location spread options.

2. Position Management

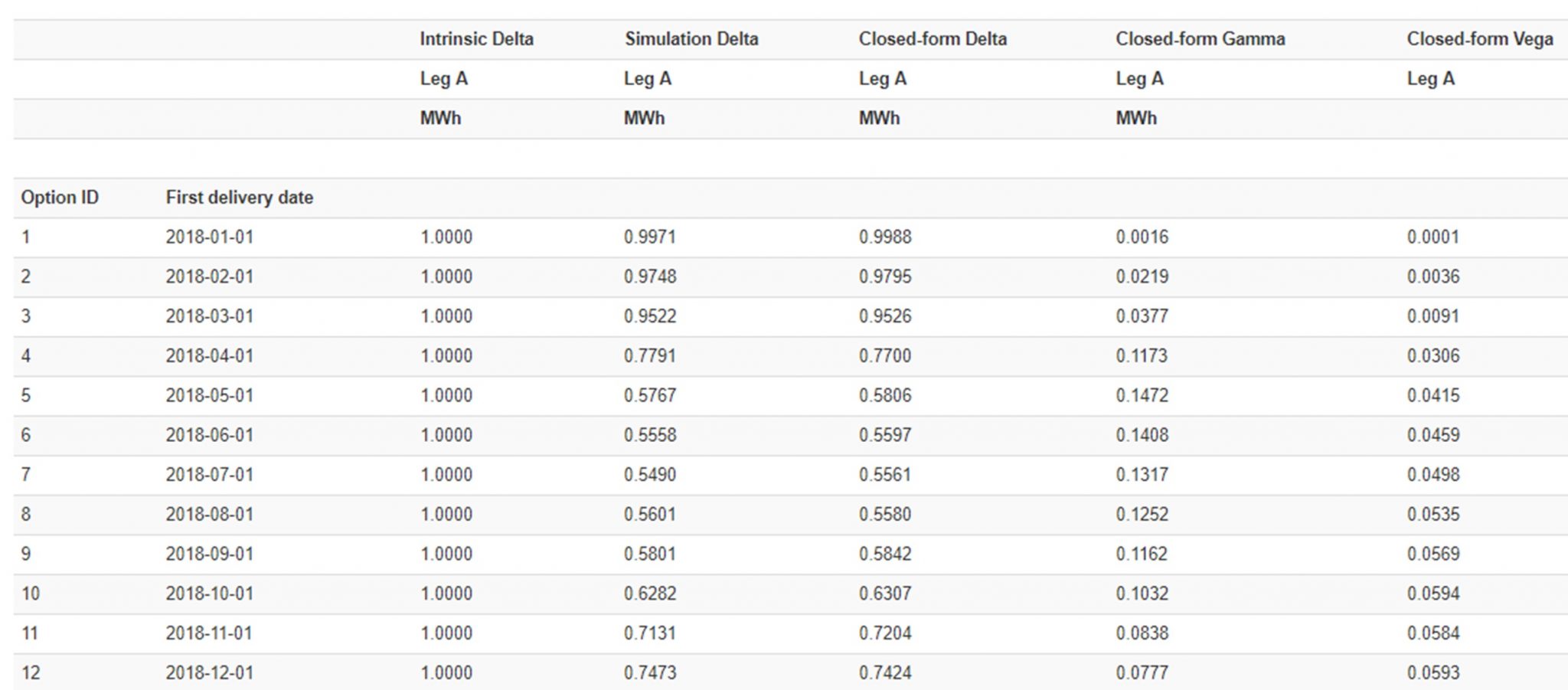

KyOption calculates the Greeks of each options which allows you to effectively manage your options. In the case of options with multiple underlyings, like commodity spread options, KyOption shows the Greeks per underlying. Furthermore, the tool displays the volatilities and correlations that are used in the calculations. The user may override these parameters with its own views.

Features

The KyOption pricing tool allows you to price a wide range of option types. An intuitive user interface allows for easy capture of single options, strip of options, commodity spread options and time spread options.

Of course we integrated KyOption in our KYOS Analytical Platform. Automated data feeds ensure that you get up-to-date prices and Greeks every day.

Methodology

The option pricing engine calculates the price of each option using Monte Carlo simulations as well as a closed-form formula solution. For the Monte Carlo simulations we use KySim, our state of the art Monte Carlo simulation engine.

Optimization modules

Trusted by organizations all over the world

Other Solutions

Consulting Services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and Valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & Risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›Price Simulations and Analytics

Market prices, market price forecasts and simulations are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›