Power plant

- Increase revenues of power plants and power products

- Deal with all power plant characteristics and optionalities

- Make quick calculations, fully automated

- Enjoy easy interfaces with market and other data

- Calculate accurate values and hedges with Monte Carlo simulations

Benefits

1. Spot market: how to dispatch?

For day ahead and intraday markets, the power plant optimization model tells you what is optimal to do: produce or don’t produce? When prices change due to unforeseen circumstances, it could be optimal to change the dispatch decision on the intraday market.

2. Forward market: keep the risk or lock in profits?

KyPlant shows which forward transactions are optimal to hedge risks and lock in profits. The user can then choose between intrinsic hedging and delta hedging, two strategies to secure profits. It can provide hedge recommendations not only for the asset alone but also for multiple assets together.

3. Power Market: What is a fair price?

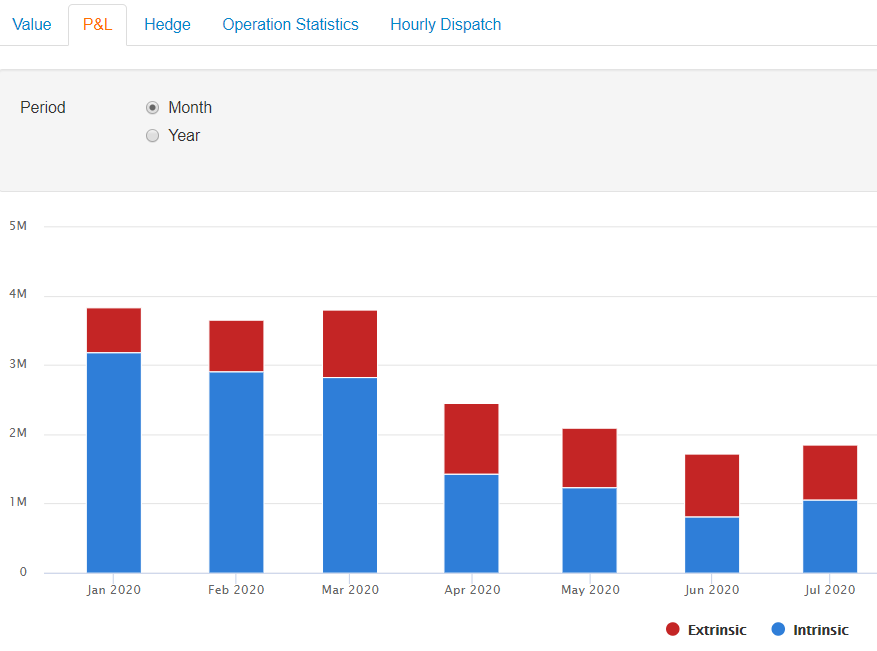

The power plant valuation model calculates the fair value of a power station. The model shows which part of the value is intrinsic and which part is extrinsic, requiring a more active trading strategy.

Extrinsic values are derived from an intuitive and realistic Monte Carlo simulation model. We apply a combination of forward and spot trading strategies to the simulated price scenarios, using dynamic programming and least-squares Monte Carlo. As a result, this type of valuation provides a fair assessment of the future value.

Furthermore, backtesting of the model is another feature: it shows how much money you would have made in the past, following a specific trading strategy.

Loading a qoute..

Loading a qoute..

Features

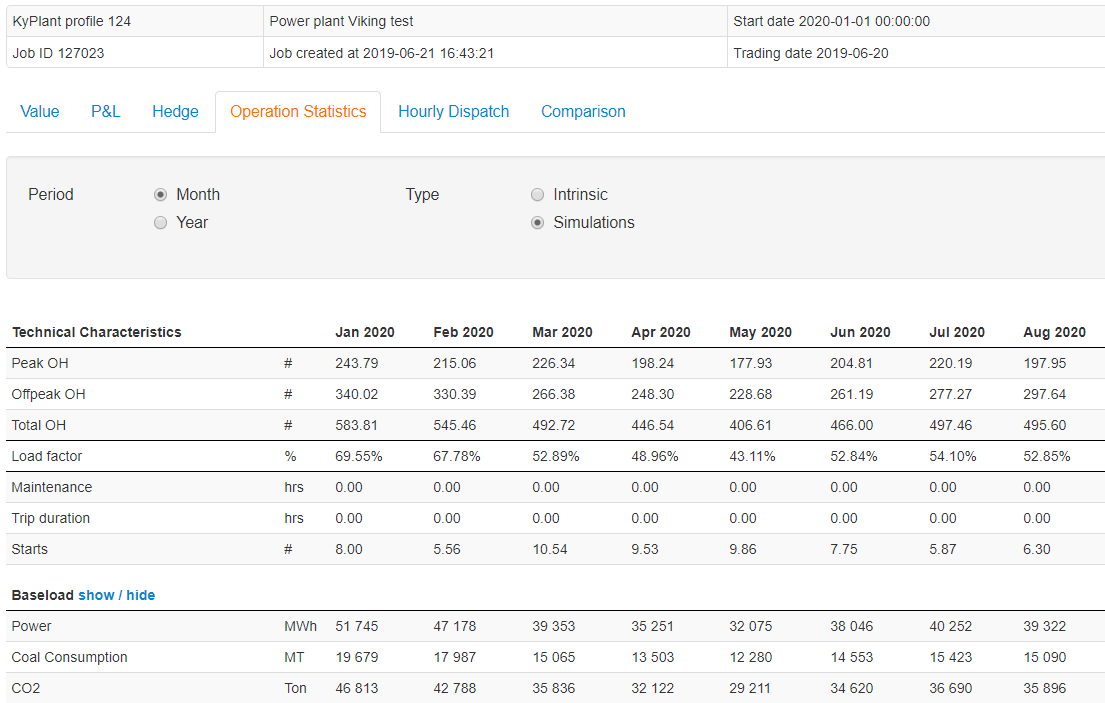

Most KyPlant users optimize the power stations at individual plant level. However, it is also possible to use our power plant optimization software effectively for a portfolio of plants, for example connected by joint heat obligations and a heat buffer. You can provide detailed technical characteristics of the power stations as input, including efficiency curves, a range of start types and curves, costs, trips, maintenance, start constraints, etc. Of course we have fully embedded KyPlant in our KYOS Analytical Platform. With automated data feeds, up-to-date plant valuations are always available.

The power plant optimization software can be applied to real physical power plants, but also virtual power plants, spark and dark spread options, and power options.

Methodology power plant optimization

KyPlant uses advanced Monte Carlo simulation techniques. Important characteristics are e.g. co-integrated commodity prices, and a mean-reverting multi-factor model with long-term, short-term and seasonal dynamics. Furthermore, users can also import their own price simulations or use those of KySim.

The model applies dynamic programming and least squares Monte Carlo techniques for optimal dispatch and exercise decisions. The accompanying calibration tool uses historical data to easily derive the volatility term structure and other simulation inputs. Similarly, you may use implied option volatilities as well, by overwriting the historical volatility estimates.

Optimization modules

Publications

- Energy Risk: implications of carbon floor on power plant hedging

- White paper: How to effectively hedge the value of a power station

- Energy Risk: Comparing power plant delta hedging strategies

- World Power: Realistic power plant valuations with cointegration

- White paper: Benefits of outsourcing energy analytics

Trusted by organizations all over the world

Other Solutions

Consulting Services

KYOS Energy Consulting offers a wide range of services to support companies with managing their (renewable) production position. Our expert services range from a one-off deal valuation to a complete solution for the risk management of a portfolio of renewable generation assets and contracts.

Read more ›Optimization and Valuation

KYOS offers fast and accurate solutions to value flexible assets and contracts in energy markets, such as power plants, gas storage facilities and swing contracts.

Read more ›Portfolio & Risk management / CTRM

Does your company have a significant exposure to commodity prices? Then KYOS has a cost-effective solution for your daily management. The KYOS CTRM offers a detailed insight in your exposures, expected cash-flows, Mark-to-Market and more.

Read more ›Risk analytics

KYOS offers unique software for measuring portfolio risks in energy and commodity markets. The risk analytics include Value-at-Risk, Cashflow-at-Risk and Earnings-at-Risk.

Read more ›Price Simulations and Analytics

Market prices, market price forecasts and simulations are essential ingredients in energy and commodity management. KYOS offers a suite of functions and quant models to create and analyze all these price series.

Read more ›